Photo by Karolina Grabowska

Alameda County is one of the most populous counties in California, as seen in how it was sought-after by many homebuyers.

If you plan to buy a new home in this area, it is crucial to understand how Alameda County property taxes work.

Property owners must pay their property taxes annually. Failure to settle tax obligations can result in penalties and interest charges.

The county sends an annual property tax bill, which, while not everyone’s favorite piece of mail, is an essential expenditure.

It supports various public services and initiatives, such as education, infrastructure, and public safety.

In this way, homeowners in the county can enjoy the advantages of living in a thriving and economically stable community.

Let’s dive more into property taxes in Alameda County and how they impact homeowners and the local community.

How Alameda County Property Taxes are Calculated

Photo by Karolina Grabowska

The property taxes you owe in Alameda County are based on your property’s assessed amount and the tax rate in your area.

The calculation is made by the Alameda County Assessor’s Office, which evaluates the value of your property based on several factors, including the following:

- Size and square footage of the property

- Age and condition of the property

- Location of the property

- Any improvements or renovations made to the property

After getting the assessed value of your home, the next step is determining the tax rate for your property.

In Alameda County, the tax rate is determined by various agencies such as the county, city, school district, and special districts.

Each agency sets its tax rate, expressed as a percentage of the property’s assessed value.

To calculate your property taxes in Alameda County, you can use the formula: Assessed Value x Tax Rate = Property Taxes.

For example, if your property has an assessed value of $300,000 and the tax rate in your community has been established at 1.20% (1% base rate plus 0.20% for prior indebtedness), the property tax would be calculated as follows: $300,000 x .0120 = $3,600.

It is important to take note that property taxes can increase or decrease yearly.

It depends on changes in your property’s assessed value and the tax rates set by various agencies.

Property owners should review their property tax statements yearly to ensure the assessed value and tax rate are accurate.

Paying Your Alameda County Property Taxes

Photo by Anna Tarazevich

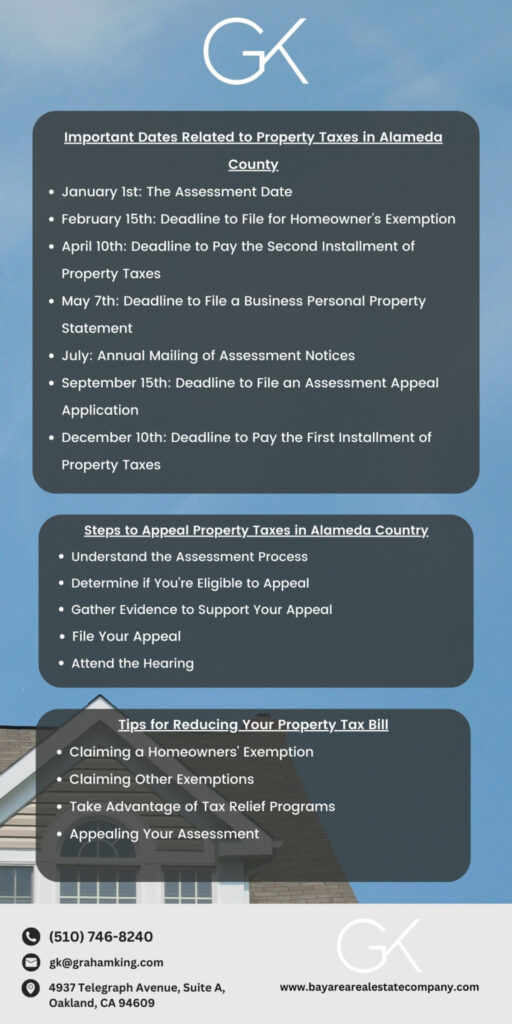

As a property owner in Alameda County, knowing how to pay your property taxes and when they are due is essential.

Understanding the critical dates and deadlines for paying Alameda County’s property taxes is crucial to avoid penalties and ensure that your payments are received on time.

Here are the important dates involved when paying property taxes in Alameda County:

January 1st: The Assessment Date

The assessment date, which is January 1st, is the day on which the value of your property is determined.

Your property taxes for the upcoming fiscal year will be determined using the assessed value of your home on this date.

February 15th: Deadline to File for Homeowner's Exemption

Homeowners, veterans, and disabled veterans may be eligible for a homeowner’s exemption of up to $7000.

It can reduce the assessed value of your property and lower your property tax bill.

The deadline to file for a homeowner’s exemption is February 15th, so submitting your application before this date is crucial if you believe you are eligible.

According to the law, if you have successfully filed for a homeowners’ exemption and keep living on the claimed property, filing for the exemption annually is not required.

April 10th: Deadline to Pay the Second Installment of Property Taxes

The property taxes in Alameda County are payable in two installments.

The deadline for the first installment would be in December of last year. Meanwhile, April 10th of the current year is the deadline for payment of the second installment of property taxes without incurring a penalty.

May 7th: Deadline to File a Business Personal Property Statement

If you own a business in Alameda County, you must file a business personal property statement without penalty with the Assessor’s Office by May 7th.

The statement lists all the taxable personal property used in your business, such as furniture, fixtures, and equipment.

July: Annual Mailing of Assessment Notices

July 1st is the day the Assessor hands over the property assessment roll to the Auditor-Controller.

Mid-July is when the Alameda County Assessor’s Office mails out assessment notices to all property owners in the county.

The notice will state the taxable value of your property, which is used to calculate your property tax bill.

September 15th: Deadline to File an Assessment Appeal Application

If you do not agree with the assessed value, you have the right to submit an assessment appeal application to the Assessment Appeals Board. The deadline to file the application is September 15th.

The process involves presenting evidence to support your claim that the assessed value of your property needs to be corrected.

December 10th: Deadline to Pay the First Installment of Property Taxes

The first installment of property taxes in Alameda County must be paid before December 10th to avoid penalties. If you miss this deadline, you will be charged with interest and penalties on any remaining balance.

Check out the Alameda County Assessor Office’s complete calendar and mark important dates and deadlines to stay on top of any property-related matters.

You can pay your property taxes online through the Alameda County Treasurer-Tax Collector’s website, by mail, or in person at their office.

If you cannot fully pay your property taxes by the deadline, you may be eligible for a payment plan or a deadline postponement.

Appealing Your Property Tax Assessment

Photo by Dziana Hasanbekava

Property tax assessments are a crucial source of revenue for local governments.

However, they can also be frustrating for property owners who feel their property has been overvalued. It can result in higher property tax bills than they believe they should pay.

Fortunately, there are ways to appeal your property tax assessment and lower your tax bill. Here are the steps involved in appealing your property tax assessment:

Understand the Assessment Process

Before you can appeal your property tax assessment, it’s essential to understand how the assessment process works.

As mentioned, the assessed value of your property is determined by the Alameda County Assessor’s Office.

The property’s assessed value is multiplied by the applicable tax rate to determine your tax bill.

Determine if You're Eligible to Appeal

Not all property owners are eligible to appeal their property tax assessment.

In Alameda County, you can only appeal your assessment if you believe that the assessed value of your property is higher than its fair market value.

Suppose you think your property is being unfairly evaluated compared to other properties in the same area. In that case, you may have a chance for an appeal.

However, you should know the critical deadlines for filing an appeal.

Gather Evidence to Support Your Appeal

To successfully appeal your property tax assessment, you must provide evidence to support your claim that your property’s assessed value is too high.

However, you must demonstrate that the property’s assessed value is significantly higher than its fair market value.

You’ll need to provide clear and convincing evidence to support your claim.

File Your Appeal

Once you’ve gathered the evidence to support your appeal, you can now file your appeal with the Alameda County Clerk of the Board of Supervisors.

The appeal form can be filed by calling (510) 272-6352 or visit their website to learn more.

You have to provide comprehensive details about your property, including the address and assessor’s parcel number, and the reasons for your appeal.

All appeal applications must be filed with the Clerk of the Board, Administration Bldg. on the 5th Floor, 1221 Oak Street, Oakland 94612.

Attend the Hearing

After you file your appeal, you’ll be scheduled for a hearing with the Assessment Appeals Board.

You’ll have the opportunity to present your evidence and argue your case. You’ll also have the chance to question the assessor’s evidence and cross-examine any witnesses who testify.

Preparing for the Assessment Appeals Board Hearing

Photo by Mikhail Nilov

Before your Assessment Appeals Board hearing, you should gather as much corroborating evidence as possible to support your case.

It may include recent sales of comparable properties in your area, appraisals, photographs of your property, and any relevant documentation, such as permits or inspections.

Appeals for regular assessments should be submitted from July 2nd until September 15th.

However, appeals for Supplemental or Escape Assessments must be filed and submitted within 60 days from the date indicated on the “Notice of Supplemental Assessment” or “Notice of Enrollment of Escape Assessment,” or the postmark on the notice, whichever comes later.

During the hearing, you can present your evidence and argue your case.

The Assessment Appeals Board considers all evidence presented by the property owner and the Assessor’s Office at a formal hearing.

The Appeals Board then determines the home value of the property in question. After the hearing, the Assessment Appeals Board will decide on your appeal.

If your appeal is successful, the assessed value of your property will be reduced, and your property tax bill will be lowered accordingly.

Tips for Reducing Your Property Tax Bill

Photo by Karolina Grabowska

Homeowners in Alameda County can find property taxes a significant expense. Nonetheless, there are ways to decrease property tax expenses.

Here are some tips to help in reducing your Alameda County property taxes:

Claiming a Homeowners' Exemption

You might qualify for a homeowners’ exemption if you own and live in your primary residence. This exemption can reduce the assessed value of your property by as much as $7,000.

Claiming Other Exemptions

You may be eligible for other exemptions, such as a disabled veteran’s exemption or a welfare exemption, depending on your circumstances.

Take Advantage of Tax Relief Programs

In addition to exemptions, Alameda County also offers tax relief programs for homeowners who meet specific criteria.

For example, the Property Tax Postponement Program allows eligible homeowners to postpone paying property taxes until the sale or transfer of their property.

Appealing Your Assessment

As discussed earlier, you can appeal it if you believe the property’s assessed value is too high.

Conclusion

Owning a property in Alameda County, CA, means paying property taxes annually based on the property’s assessed value and the tax rate.

County property owners can benefit from the taxes they pay as they fund public services and programs.

Understanding how property taxes are calculated and when they are due is crucial in avoiding penalties and ensuring payments are made on time.

If property owners disagree with the assessed value of their property, they can appeal the assessment by following the necessary steps.

Homeowners must review their property tax statements each year to ensure accuracy and to take advantage of any exemptions or appeals that may be available to reduce their property tax bill.

By staying informed and engaged in the property tax process, you can ensure that you pay a fair amount for the services provided by local agencies and organizations.

For more information or inquiries about Alameda County Property Tax, please do not hesitate to get in touch with our team. You can contact us at (510) 746-8240 or send us a message throughgk@grahamking.com.

To stay up-to-date on the latest news and updates about Alameda County, we encourage you to follow us on our social media platforms:

Photo by Polina Tankilevitch

Frequently Asked Questions

Why is the Alameda County tax so high?

The property tax rate in Alameda County can be considered high compared to other areas due to the region’s high living costs.

Because of this, the region necessitates increased funding for essential public services such as schools, healthcare, and infrastructure.

Additionally, Alameda County has many special districts, which can result in higher property taxes for some residents.

What are the taxes in Alameda County?

In addition to property taxes, residents of Alameda County are also subject to sales taxes, which vary by city and state income taxes.

How much is property taxes in Alameda, CA?

The property taxes a homeowner pays in Alameda County depends on the assessed value of their property multiplied by the tax rate in their area.

For example, if your property has an assessed value of $500,000 and the property tax rate is around 0.79% in your area, your property taxes would be approximately $3,800 annually.

How does California property tax work?

In California, property taxes are based on a property’s assessed value and the tax rate of the area.

The assessed value is calculated by the county assessor’s office and is based on the property’s fair market value during the time of purchase plus an annual inflation factor of no more than 2%.

The tax rate is set by various agencies such as the county, city, school district, and special districts and is expressed as a percentage of the property’s assessed value.

California’s maximum property tax rate is 1%, which can be increased by voter-approved bond measures or extraordinary taxes for specific purposes.