Buying a home involves additional costs on top of the property’s purchase price. These are closing costs – the fees, charges, and taxes that are due at the settlement of a real estate transaction to both buyers and sellers.

Home buyers pay for most of the Bay Area closing costs. They have the option to roll some or all of their closing costs into a loan. Sellers, on the other hand, can take out their closing costs from the proceeds of the sale. These expenses vary depending on where you’re buying a property, and so it pays to do your research so you can include this in your budget.

Let’s deep dive into the closing costs for both the buyers and the sellers in the San Francisco Bay Area.

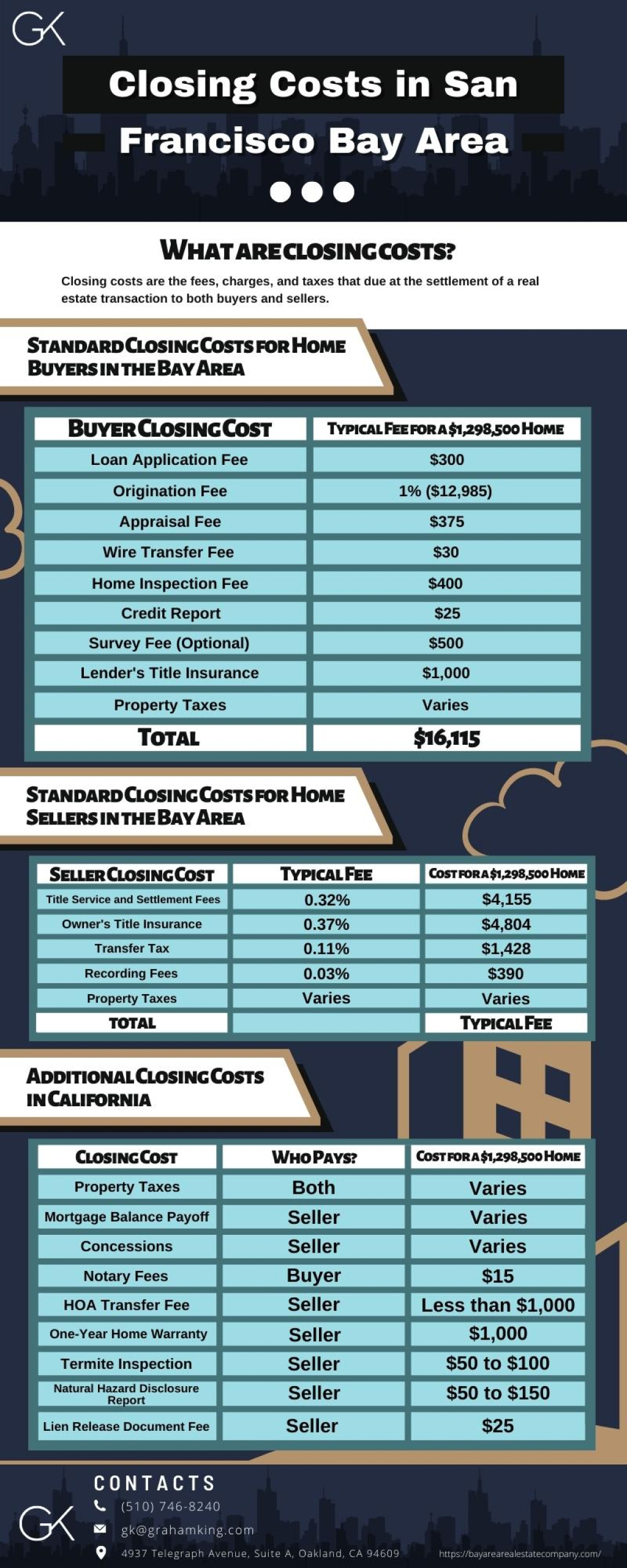

Standard Closing Costs for Home Buyers in the Bay Area

When it comes to closing costs, Bay Area home buyer closing costs average around 3% to 5% of the purchase price.

Here’s a list of the standard buyer closing costs in the Bay Area:

| Buyer Closing Cost | Typical Fee for a $1,298,500 Home |

|---|---|

| Loan Application Fee | $300 |

| Origination Fee | 1% ($12,985) |

| Appraisal Fee | $375 |

| Wire Transfer Fee | $30 |

| Home Inspection Fee | $400 |

| Credit Report | $25 |

| Survey Fee (Optional) | $500 |

| Lender's Title Insurance | $1,000 |

| Property Taxes | Varies |

| Total | $16,115 |

Based on the costs listed above, you can expect to pay a little over $16,000 for a home valued at $1,298,500, which is the average home sale price in the Bay Area as of June 2022.

Standard Closing Costs for Home Sellers in the Bay Area

Bay Area home sellers pay approximately 0.83% of a property’s final sales price. This would translate to roughly over $10,000 for an $1,298,500 home, excluding property taxes and the real estate agent commission.

Below is a list of the standard seller closing costs in the Bay Area:

| Seller Closing Cost | Typical Fee | Cost for a $1,298,500 Home |

|---|---|---|

| Title Service and Settlement Fees | 0.32% | $4,155 |

| Owner's Title Insurance | 0.37% | $4,804 |

| Transfer Tax | 0.11% | $1,428 |

| Recording Fees | 0.03% | $390 |

| Property Taxes | Varies | Varies |

| Total | $10,777 | |

California Realtor Commission

The average California real estate agent commission in 2022 is 4.92%. This percentage includes both the buyer’s and seller’s agents, with each agent earning an average of 2.46% of the home sale price.

Based on the average home sale price in the San Francisco Bay Area, the realtor commission would amount to around $64,000. This particular closing cost is paid by the seller.

Additional Closing Costs in California

Aside from the standard closing costs mentioned above, there are some expenses that vary according to your specific transaction. It is best to work with your real estate agent so you have a better grasp of how much the applicable fees will add up to your closing costs.

| Closing Cost | Who Pays? | Typical Fee |

|---|---|---|

| Property Taxes | Both | Varies |

| Mortgage Balance Payoff | Seller | Varies |

| Concessions | Seller | Varies |

| Notary Fees | Buyer | $15 |

| HOA Transfer Fee | Seller | Less than $1,000 |

| One-Year Home Warranty | Seller | $1,000 |

| Termite Inspection | Seller | $50 to $100 |

| Natural Hazard Disclosure Report | Seller | $50 to $150 |

| Lien Release Document Fee | Seller | $25 |

Property Taxes

For buyers, they have the option to wait until the end of the year to pay their share of taxes and not at closing. In this case, their lender may require them to put tax money into an escrow account, which they will disperse when the property taxes are due. If the seller already paid the property taxes in full for that year, the buyer would have to credit the seller a prorated amount.

For sellers, they will be responsible for prorated property taxes. This is calculated by the number of days prior to the closing day.

Mortgage Balance Payoff

The seller pays off the remaining amount owed on the mortgage to the lender at the close of escrow. This is done before the seller receives any proceeds from the sale of the house. This closing cost may also include a loan payoff fee and a prepayment penalty, depending on the lender.

Closing Cost Concessions

It is common practice for buyers to ask the seller to cover their closing costs. If the seller agrees to this request, then they will pay the amount agreed upon in the contract. One of the typical expenses that sellers agree to shoulder is repair costs.

Notary Fees

Notary fees are standard in most legal processes, used to verify identity and ensure proper execution of paperwork. In California, there is a flat fee of $15 and is typically paid by the buyer.

Homeowners Association (HOA) Transfer Fee

An HOA transfer fee only applies if the property being sold has an HOA. This fee covers document preparation and registration of the buyer as the new property owner. This cost is usually paid for by the seller.

Cost of Home Warranty

A home warranty is a common closing concession provided by the seller. The coverage period for the warranty generally lasts for one year.

Termite Inspection Fee

A termite inspection fee is common in the state of California and is paid for by the seller. Termite inspection may be required depending on the location of the property and the type of loan the buyer is using.

Natural Hazard Disclosure Report

Most home sellers in California are required to provide a Natural Hazard Disclosure (NHD) report. This report details the natural hazards or threats in the area where the property being sold is located, including earthquake fault lines, flood zones, and other nuisances such as airplane noise.

Lien Release Document Fee

If a court judgment resulted in a lien on the property for an unpaid debt, the seller is required to repay it before the sale can close. A lien release document, also known as a release of lien or a lien cancellation, provides confirmation that any lien against the property has been paid.

If you’re currently looking to buy a house in the San Francisco Bay Area, I’ll be more than happy to show you all the available properties in this amazing location. Feel free to call me at (510) 746-8240 or send me an email at gk@grahamking.com for any questions or if you’d like to schedule an appointment.