Public Domain Some rights reserved by Foto Miki Digital

As you probably know by now, the SF housing market is pretty wild. Some current renters are choosing to buy a vacation home outside the Bay Area rather than buy a primary residence in Northern California.

Bidding wars can be so fierce that buyers can overpay the listing price by 10% to 35%. That may be after a full year of searching for a new home. So how do you cut through the competition and buy an excellent property? Because it’s definitely possible with the right preparation.

This article focuses on ways to streamline the process of buying a San Francisco Bay Area home. Let me help you save money, reduce stress, and optimize the home-buying process.

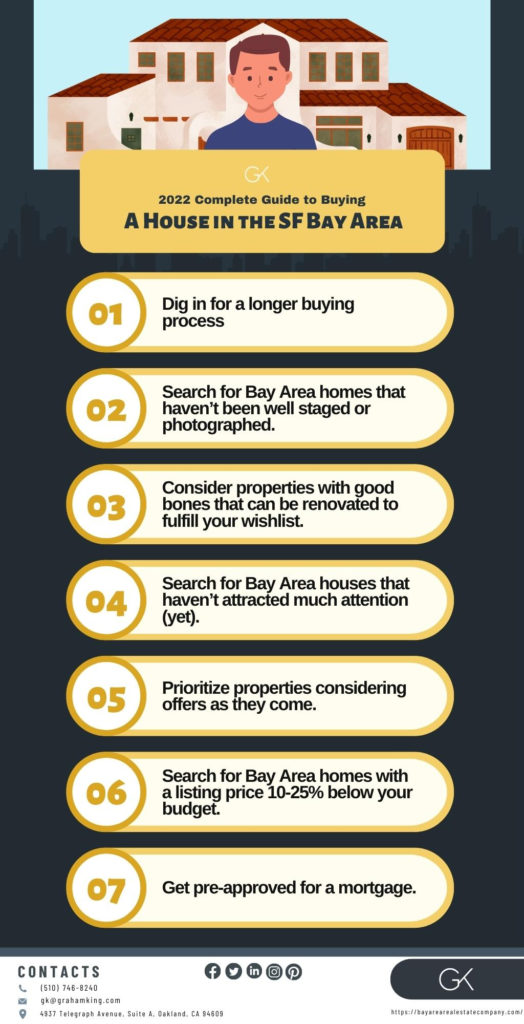

Tips for Buying San Francisco Bay Area Homes

1. Dig in for a longer buying process.

Unless you have the means and willingness to overpay 25-30% right out of the gate, you should prepare to spend at least 6 months searching. That’s a rough estimate for people looking for a primary residence that fulfills a wishlist without overpaying much.

So how do you do that?

- Start looking before you’re fully prepared to commit.

- If you want to buy during the down season, which is winter, start in August or September.

- Go to lots of open houses and neighborhood drives early.

- Collect all the documentation necessary for applying for a mortgage before you make offers.

2. Search for Bay Area homes that haven’t been well staged or photographed.

First, this allows you to view homes with less attention. It can also indicate the seller isn’t preparing well to get the highest selling price.

3. Consider properties with good bones that can be renovated to fulfill your wishlist.

Widen your search parameters by thinking long-term. Look at properties in terms of their potential.

4. Search for Bay Area houses that haven’t attracted much attention (yet).

Stay vigilant about new listings. It’s better to spend 15 minutes every day looking for potential homes than 2 hours every weekend.

5. Prioritize properties considering offers as they come.

As with poorly photographed and unstaged homes, this is a sign the seller isn’t preparing to sell at the best price possible. Take advantage!

6. Search for Bay Area homes with a listing price 10-25% below your budget.

In such a strong seller’s market, people expect to sell that much higher than the listing price. Don’t waste time getting into bidding wars you can’t afford. By jumping down a price bracket, you position yourself with an advantage over competing buyers who haven’t done the same.

Besides being realistic about your budget, it’s also important to be prepared for closing costs. You don’t want an accepted offer to fall through because you got shell-shocked by the closing costs.

7. Get pre-approved for a mortgage.

Show sellers they can choose you confidently. Before you make an offer on any Bay Area home you love, reach out to your lender.

Public Domain Some rights reserved by Foto Miki Digital

Checklist for Buying San Francisco Area Real Estate

Let’s assume you know the basics of buying real estate. You have to evaluate your financial situation, then double and triple-check it. You have all the documentation ready to get pre-approved for loans before making offers. You’ve started looking at listings online and even going to some open houses.

Check, check, check. What else is there?

1. Find the right neighborhoods.

A prioritized list of neighborhoods you want to live in is a fantastic way to narrow down and optimize your search.

If you don’t have time to drive through neighborhoods, there are many neighborhood tours on YouTube.

Here are comprehensive neighborhood breakdowns for several Bay Area regions and cities.

2. Find a solid Bay Area real estate agent.

My name is Graham King, and I’ve been residing in San Francisco and the Bay Area since I was born. My past professional experiences coalesce into a powerful skill set for helping you buy and sell real estate in the Bay Area.

In addition to a background in video production (essential for selling luxury properties), I also own a vintage Airstream restoration company, a real estate investment company, and a nonprofit charity, The King Family Foundation. Plus, my wife and I renovated our home from top to bottom.

While I’m proud of my real estate agent skill set, maybe the most important thing I want to share is my love for helping people find a new nest home. It’s a privilege to help people build a bright future in the place I’ve called home my entire life.

But don’t just take my word for it. Here’s a recent client testimonial.

“We engaged Graham early in the process of getting our house ready to sell. We had a lot of work to do and Graham was able to find contractors that could help on short notice, which was an amazing feat considering the market conditions. Graham's patience and guidance were instrumental in us getting 36% over our asking price. We are very grateful for his support. I highly recommend Graham to anyone needing a real estate agent who looks out for his clients.”

Frank Moura

Public Domain Some rights reserved by Foto Miki Digital

Credit Score for Buying Bay Area Homes

You may be wondering what kind of credit score is necessary to buy a house in San Francisco or the surrounding Bay Area. The overly simple answer to this complicated question is 600.

However, mortgage lenders prefer to look at the big picture before deciding whether to lend and which rate to give. Below you can find a table with estimated APRs based on different credit scores.

The figures come from a 30-year mortgage of $900,000 with a 20% down payment. Again, these are ballpark figures as there are no hard and fast rules.

| FICO Score | APR* | Monthly Payment | Total Interest Paid | Price Changes |

|---|---|---|---|---|

| 760-850 | 4.84% | $4,740 | $646,206 | If your score changes to 700-759, you could pay an extra $34,485 |

| 700-759 | 5.06% | $4,863 | $680,961 | If your score changes to 760-850, you could save an extra $34,485 |

| 680-699 | 5.23% | $4,962 | $708,102 | If your score changes to 700-759, you could save an extra $35,141 |

| 660-679 | 5.45% | $5,082 | $743,588 | If your score changes to 699-680, you could save an extra $35,486 |

| 640-659 | 5.88% | $5,325 | $814,094 | If your score changes to 660-679, you could save an extra $70,506 |